People who are new to Medicare often have a hard time sorting things out in the beginning. There are all these parts and plans with similar letters, which makes it hard to figure out what is what. You are bombarded with literature that is not only un- helpful, but also extremely overwhelming! The time it takes to stay up-to-date and navigate your way through the ever changing Medicare Program, that includes using multiple web-sites, and marketing calls from different companies is very daunting!

Welcome To Medicare

That is what I will do for you at NO COST- Save YOU $ and Time!

I will do all the work, and together we can make the best decision for your Medicare Advantage or Medicare Supplement choices. I will work for you to find the best plan to meet your needs, with the least amount of expense to you…

Since I represent many of the top Medicare Advantage and Medicare Supplement companies in this area, you will only have to work with me, rather than dealing with each insurance company individually; And remember, I am able to provide this service at NO COST TO YOU!!! Again, I do ALL the work!

IMPORTANT!: Original MEDICARE does NOT cover many healthcare benefits and services that you may need…

Medicare Questions You May Have:

1.) How do I know which Medicare Advantage Plan is best for me and why?

2.) What is the cost of the plan, and is there a monthly premium?

3.) What do I pay to see my doctor, specialist, and lab work?

4.) What if I have to go the hospital, what will I pay?

5.) How much are my prescription drugs?

6.) What is meant by the GAP, and is there a plan that will cover me through it?

7.) What is a Medicare Supplement?

8.) How do I enroll in a Medicare Advantage or Medicare Supplement Plan?

9.) How do I find plan with NO monthly premium cost?

Annual Enrollment: coverage during the annual open enrollment period, which will run each year from Oct. 15 to Dec. 7.

Not all Medicare plans are created equal

Medicare Part A

What is Medicare Part A coverage?

Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided in the U.S. without a break for at least five years. You’re eligible if you’re 65 and older or under age 65 with certain disabilities. You may also qualify at any age if you have end-stage renal disease or amyotrophic lateral sclerosis (also known as Lou Gehrig’s disease). Together with Medicare Part B, it makes up what is known as Original Medicare, the federally administered health-care program. Medicare Part A helps pay for the cost of inpatient hospital care, while Part B covers outpatient medical services.

In general, Part A covers:

• Hospital care

• Skilled nursing facility care

• Nursing home care (as long as custodial care isn’t the only care you need)

• Hospice

• Home health services

Medicare Part B

Part B covers 2 types of services

- Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

- Preventive services: Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

You pay nothing for most preventive services if you get the services from a health care provider who accepts assignment.

Part B covers things like:

- Clinical research

- Ambulance services

- Durable medical equipment (DME)

- Mental health

- Inpatient

- Outpatient

- Partial hospitalization

- Getting a second opinion before surgery

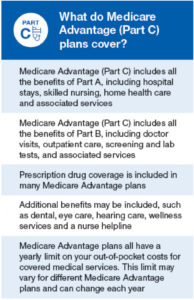

Medicare Part C

Medicare Advantage (Part C)

This option provides several different alternatives to traditional Medicare, each offered through many private insurance plans that Medicare approves and regulates. Every year Medicare gives each plan a set amount of money toward the care of each person enrolled in the plan, regardless of how much health care he or she uses, and you pay what the plan requires for each service. Each plan must provide at least the same services as traditional Medicare but may offer extra benefits. Costs and benefits vary a great deal among plans. Overall, some enrollees pay less than they would in traditional Medicare and others pay more. You must be enrolled in both Medicare Part A and B to join an MA plan. Most plans charge a monthly premium (in addition to the Part B premium), but some require no premium.

Here, briefly, are the main features of different types of

Medicare Advantage plans:

Medigap can be used only by people enrolled in traditional Medicare. It is not a government-run program, but private insurance you can purchase to cover some or most of your out-of-pocket expenses in traditional Medicare. These may include Part B costs, like the 20 percent you’d otherwise pay for physician visits and other outpatient services, the Part A hospital deductible ($1,216 in 2014 for each hospital benefit period), most of the cost of medical emergencies abroad and certain other outlays, depending on which kind of policy you choose. Each of the 10 types of medigap policies is standardized by law — meaning the benefits of each are the same, regardless of which insurer sells it. But insurers still charge widely different premiums, so it pays to shop around.

The benefits of a Medicare Supplement plan can be:

• Freedom to see any provider that accepts Original Medicare, Part A and Part B

• Minimal to no cost sharing for Medicare-covered services, depending on the plan

• Freedom to use the plan nationwide (except for Medicare SELECT plans)

• No medical underwriting if the plan is purchased during the Medigap Open Enrollment Period, which lasts six months beginning the month a beneficiary turns 65 and is enrolled in Medicare Part B

Nearly one in three seniors today is choosing to bundle hospital, medical and drug insurance coverage into a single package — and premium — by opting to go with Medicare Part C coverage, better known as a Medicare Advantage Plan.

One good reason why: When compared to the combined costs of purchasing Parts A, B and D insurance, as well as a Medigap policy under Original Medicare, the condensed costs of an Advantage plan appeal to the bottom lines of a growing number of seniors.

How to get drug coverage

Medicare offers prescription drug coverage to everyone with Medicare. If you decide not to get Medicare drug coverage when you’re first eligible, you’ll likely pay a late enrollment penalty unless one of these applies:

• You have other creditable prescription drug coverage

• You get Extra Help

To get Medicare drug coverage, you must join a plan run by an insurance company or other private company approved by Medicare. Each plan can vary in cost and drugs covered.

2 ways to get drug coverage

1. Medicare Prescription Drug Plan (Part D). These plans (sometimes called “PDPs”) add drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private Fee-for-Service (PFFS) Plans, and Medicare Medical Savings Account (MSA) Plans.

2. Medicare Advantage Plan (Part C) (like an HMO or PPO) or other Medicare health plan that offers Medicare prescription drug coverage. You get all of your Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) coverage, and prescription drug coverage (Part D), through these plans. Medicare Advantage Plans with prescription drug coverage are sometimes called “MA-PDs.” You must have Part A and Part B to join a Medicare Advantage Plan

Medicare Part D

What is Medicare Part D prescription drug coverage? As a Medicare beneficiary, you don’t automatically get Medicare Part D prescription drug coverage. This Medicare Part D coverage is optional, but can be valuable if you take medications. If you don’t sign up for Medicare Part D Coverage when you’re first eligible, you might have to pay a late-enrollment penalty if you decide to enroll later. Many people are automatically enrolled in Original Medicare, Part A and Part B, when they reach 65 years of age. But you may not realize that Original Medicare doesn’t cover most of your medications (except those you may receive as a hospital inpatient or, in some cases, outpatient). Medicare Part B covers certain prescription drugs that you get in an outpatient setting, like a doctor’s office. However, these tend to be the kind of medications that you need a doctor to give you, like infusion drugs. If you want help with most other medication costs, you’ll need to sign up for Medicare Part D coverage. What types of Medicare Part D Prescription Drug Plans are available? You can get Medicare Part D prescription drug coverage in two different ways, depending on whether you’re enrolled in Original Medicare or Medicare Advantage. Medicare Advantage, also known as Medicare Part C, is an alternative way to get your Original Medicare benefits through a Medicare health plan, and many plans may also cover benefits beyond the federal program, including prescription drug benefits. Medicare Part D coverage is available: • Through a stand-alone Medicare Part D Prescription Drug Plan—you can add this benefit to your Original Medicare coverage. You can enroll in any Part D Prescription Drug Plan that serves the area where you live. • Through a Medicare Advantage Prescription Drug plan—you can get a Medicare Advantage (Part C) plan that includes prescription drug coverage, so that you get all your Medicare benefits under one plan.

Medigap Or Medicare Advantages

What's Medicare Supplement Insurance (Medigap)? A Medicare Supplement Insurance (Medigap) policy, sold by private companies, can help pay some of the health care costs that Original Medicare doesn’t cover, like copayments, coinsurance, and deductibles. Some Medigap policies also offer coverage for services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap policy, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then your Medigap policy pays its share. A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits.

What is Medicare Part C, or Medicare Advantage?

Medicare Advantage plans are sometimes referred to as Medicare Part C. They are Medicare-approved private health insurance plans for individuals enrolled in Original Medicare, Part A and Part B. When you join a Medicare Advantage plan, you are still in the Medicare program and must continue paying your Part B premium.

What’s Medicare Supplement Insurance (Medigap)?

A Medicare Supplement Insurance (Medigap) policy, sold by private companies, can help pay some of the health care costs that Original Medicare doesn’t cover, like copayments, coinsurance, and deductibles.

Some Medigap policies also offer coverage for services that Original Medicare doesn’t cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap policy, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then your Medigap policy pays its share.

A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits.

What is Medicare Part C, or Medicare Advantage?

Medicare Advantage plans are sometimes referred to as Medicare Part C. They are Medicare-approved private health insurance plans for individuals enrolled in Original Medicare, Part A and Part B. When you join a Medicare Advantage plan, you are still in the Medicare program and must continue paying your Part B premium.

Medicare Advantage plans provide all of your Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) coverage. They generally offer additional benefits, such as vision, dental, and hearing, and many include prescription drug coverage. These plans often have networks, which mean you may have to see certain doctors and go to certain hospitals in the plan’s network to get care.

Medicare Advantage plans may potentially save you money because out-of-pocket costs in these plans can be lower than with Original Medicare, Part A and Part B, in some cases. Pricing will vary by plan provider, so it’s worthwhile to compare all plans in your area. Your costs will vary by the services you use and the type of plan you purchase. Each Medicare Advantage plan can charge different out-of-pocket costs and have different rules for how you get services (like whether you need a referral to see a specialist or can use only doctors, facilities, or suppliers in the network).

• Home health services